Why Energy Infrastructure?

Home › Why Energy Infrastructure?

Power that Performs

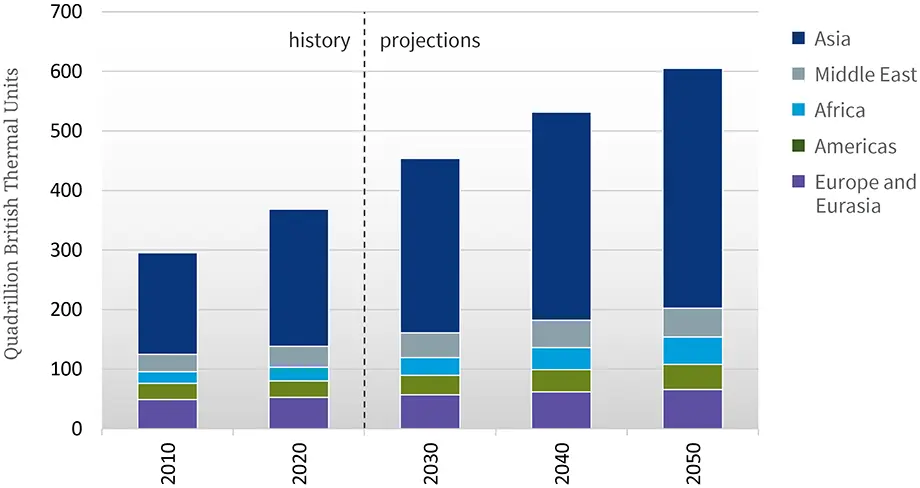

Despite its undeniable importance to the world, energy infrastructure can be an overlooked sector – though we believe this is poised to change soon … Global energy demand is forecast to see significant above-trend growth that will extend into the coming decades (view slide). We believe Midstream energy companies are well positioned to capitalize on that increased demand and support both traditional and transitional energy infrastructure.

Global Energy Demand

Source: IEO2021 Release, CSIS, October 6, 2021

Chickasaw Capital Management, LLC – adviser to the MainGate MLP Fund – gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future.

No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

The MainGate MLP Fund is distributed by Quasar Distributors, LLC.

Chickasaw Capital Management – adviser to the MainGate MLP Fund – is a renowned investment team comprised of energy infrastructure specialists, providing capital and operational insight to select entities that are positioned to fuel the global economy. The entities and assets in which we invest provide enduring, essential services supplying the full range of end-users – consumers, industries, businesses, governments and society as a whole. Investing in energy infrastructure is investing in mission-critical real assets that can provide a compelling array of potential benefits.

Established Strategy

Chickasaw embraces an approach that recognizes both the prominence of traditional energy demand and the desire to transition toward other means of feeding our energy-hungry world. This disciplined, multi-pronged strategy allows us to seamlessly adapt to market dynamics, while striving for the most optimal investment outcomes.

Using a time-tested combination of proprietary operational models and qualitative analysis, our team evaluates each candidate in our investment universe in order to identify the most promising opportunities. Our 360° research view captures a clear and comprehensive view of supply and demand trends spanning the entire energy value chain. Reaching from research to the corporate world, we interface directly with the management teams of the companies in our portfolio, leveraging meaningful relationships we’ve cultivated across decades in the industry.

As asset managers and investors seek yield, liquidity and inflation adjusted cash flow growth, we believe investments in energy infrastructure will continue to deliver on those goals ... both now and well into the foreseeable future.

ENERGY INFRASTRUCTURE HIGHLIGHTS

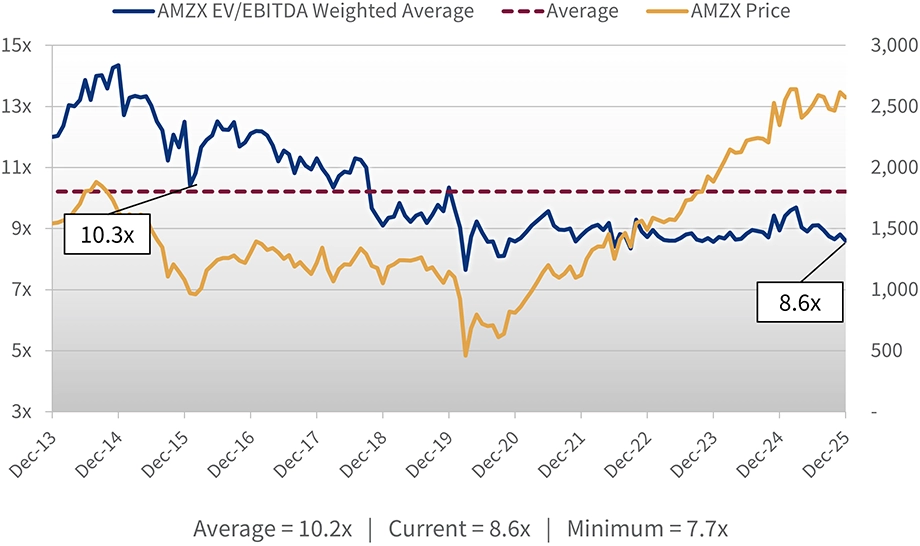

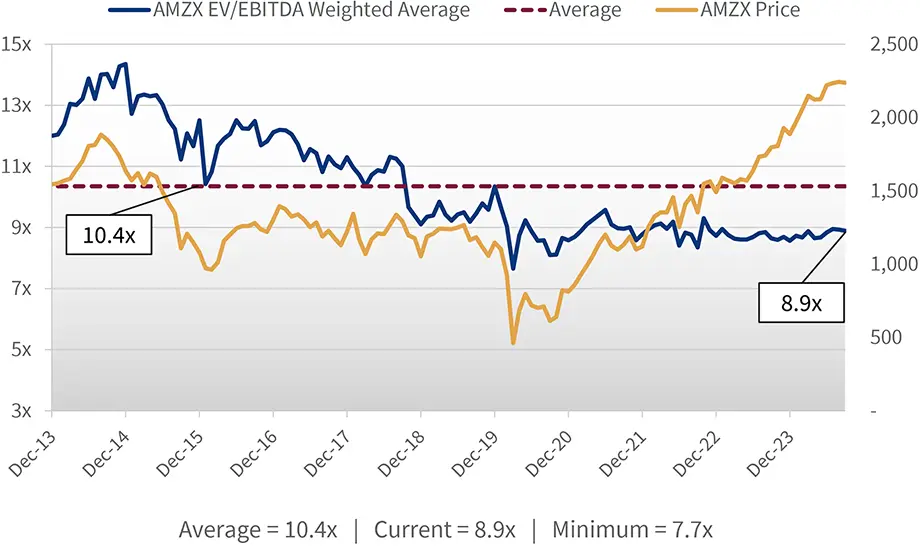

Valuation

Potential revaluation could be a source of return

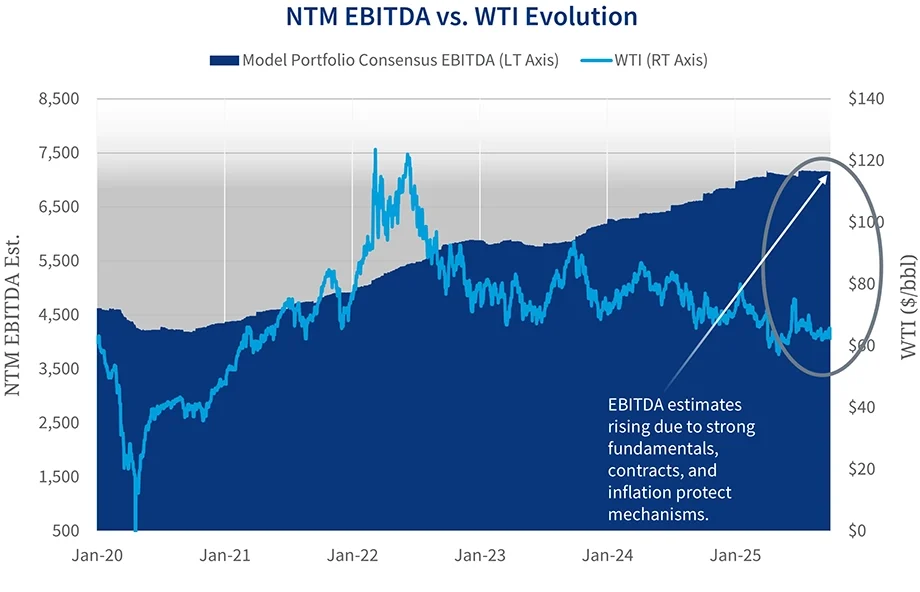

Historical Cash Flow Stability

Attractive income supported by long-term contracts

Comparison with

Other Asset Classes

Solid historical performance

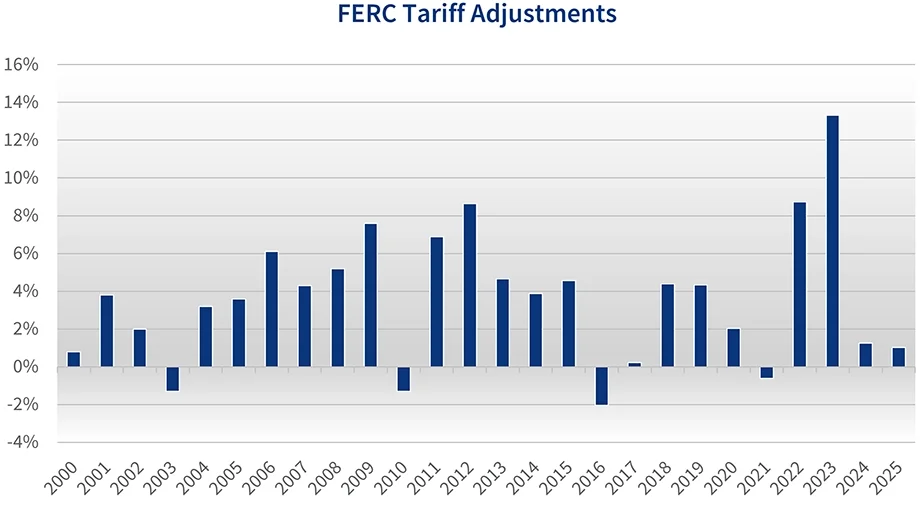

Inflation Hedge

History of outperforming other investments during high inflationary periods

Potential Tax Advantages

Distributions may be tax-deferred or subject to other preferential tax treatment

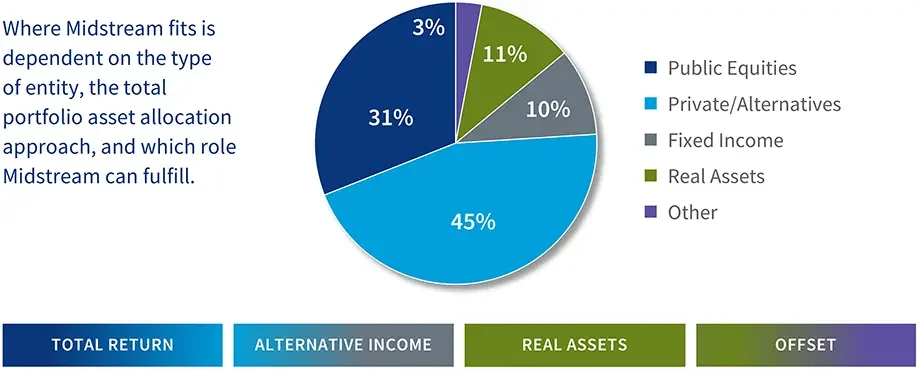

Allocation

Flexibility to play a role in several portfolio allocation categories

You should consider the MainGate MLP Fund’s (“Fund”) investment objectives, risks, charges and expenses carefully before investing. For a prospectus that contains this and other information, click here. To have a hardcopy prospectus mailed to you, call 855.MLP.FUND (855.657.3863).

The Fund is offered only to United States residents and information on this website is intended only for such persons. Nothing on this website should be considered a solicitation to buy or an offer to sell shares of the Fund in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. Past performance does not guarantee future results. Index performance is not illustrative of fund performance. An investment cannot be made directly in an index. Diversification does not assure a profit or protect against a loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund will invest in Master Limited Partnerships (MLPs) which concentrate investments in the natural resource sector and are subject to the risks of energy prices and demand and the volatility of commodity investments. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment. Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates.

An investment in the Fund does not receive the same tax advantages as a direct investment in the MLP. The Fund is treated as a regular corporation or “C” corporation and is therefore subject to U.S. federal income tax on its taxable income at rates applicable to corporations (currently at a rate of 21%) as well as state and local income taxes. MLP Funds accrue deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investments. This deferred tax liability is reflected in the daily NAV and as a result the MLP Fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked. The potential tax benefits from investing in MLPs depend on them being treated as partnerships for federal income tax purposes.

Financial statements are presented for convenience and information purposes only, and while reasonable efforts have been made to ensure the integrity of such information, they should not be relied on. A copy of the printed financial statements will be provided on request.